When my Capital One CreditWise notification popped up saying my score had increased, I instantly logged in and saw the number 803.

It was my first time ever hitting the 800s, and I just sat there for a moment, letting it sink in.

🎥 Prefer a quick visual story?

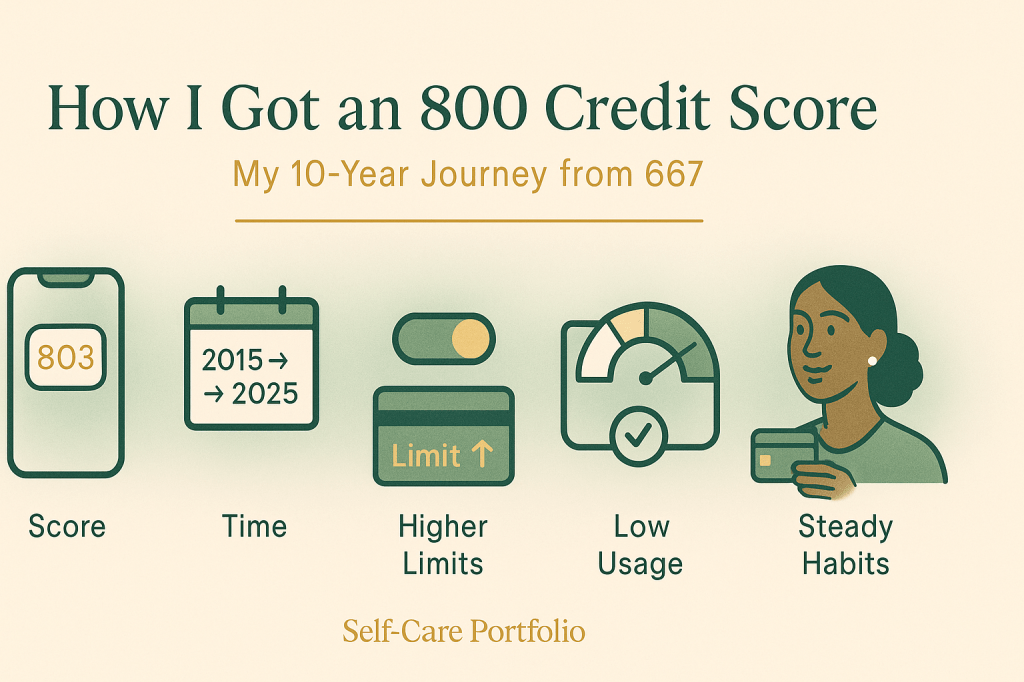

Here’s a short video sharing my 10-year journey to reaching an 800 credit score how quiet consistency, patience, and small self-care habits with money led to lasting confidence and stability.

What made it sweeter was realizing this has been a 10-year journey.

My first recorded score on Credit Karma was 667 in May 2015 my true starting point.

From there, the numbers moved slowly but surely:

- September 2023: 754

- September 2024: 768

- August 2025: 803

A decade of quiet, consistent growth built one practical habit at a time.

Nothing overnight. No quick hacks. Just steady progress that finally added up.

1. Paying On Time, Every Time (Even When Life Got Busy)

It’s basic advice for a reason: on-time payments matter most.

I set autopay to at least the statement balance years ago so I wouldn’t risk a late payment even if I forgot. This one habit took the pressure off and kept my history spotless, which is a huge factor in your score. It didn’t feel flashy, but it worked quietly in the background for years.

2. Opening Credit Strategically, Not Constantly

I only had one credit card from 2016 for nearly seven years and didn’t open a second until late 2022, when I decided to get Invisalign.

Instead of paying it all through my savings, I found a promotion: 14 months of no interest. I used that card for every Invisalign payment, paid it off within the promotion window, and in the process, increased my available credit. It was a win-win financing something I needed while boosting my utilization ratio.

3. Asking for Credit Limit Increases (At the Right Time)

Over the last three and a half years, I’ve been consistently requesting credit limit increases not randomly, but after pay increases (from raises or job changes) or when my balance was near zero.

This slowly grew my total available credit to over $51,000 across two cards, which dropped my utilization rate significantly. Lower utilization = a happier credit score.

4. Letting Time Do Its Thing

Length of credit history matters, and you can’t rush it.

My first card, opened in 2016, is still active. I keep it in rotation with small purchases to maintain that long, positive history. Patience really is part of this game just let time, consistency, and a few smart moves do the work.

Quiet Effort Pays Off

When I saw 803, it wasn’t about perfection. It was about consistency.

I didn’t obsess. I just stayed steady: paid on time, opened credit strategically, raised my limits, and gave it time.

More importantly, it reminded me that financial health is part of my Self-Care Portfolio. This wasn’t just about a number it was about how small, protective systems (like autopay and patience) built confidence and stability over time.

- Skill Development: learning how credit works and making choices that build over years.

- Well-Being: reducing stress by setting systems (like autopay) to protect peace of mind.

- Creativity & Expression: designing a financial plan that gave me flexibility, not pressure.

🌱 Self-Care Takeaways

- Consistency matters more than perfection. (Skill Development)

- Autopay is self-care it protects you from slip-ups and preserves peace of mind. (Well-Being)

- Credit growth isn’t about doing more; it’s about doing a few things right for a long time. (Skill Development)

- Patience is part of the process time itself is an ally. (Well-Being + Creativity)

FAQ

What does a credit score of 800 get you?

An 800 is considered ‘exceptional’ credit (that’s what my Capital One CreditWise calls it). It can unlock lower interest rates, higher credit limits, and better loan approvals giving you more financial flexibility.

How rare is a credit score of 800?

It’s not common, but it’s not impossible either. Around 20% of Americans have a score of 800 or above. It takes time, consistency, and healthy credit habits.

Is it hard to get an 800 credit score?

It’s challenging, but not out of reach. For me, it took ten years through my mid 20s now into my mid-30s of steady effort: paying on time, managing utilization, and letting credit history build.

What habits build a high credit score?

The biggest ones are paying on time, keeping utilization low, maintaining long credit history, and opening new credit strategically. These habits compound over time.

📝 Journal Prompt

What financial habit could you set today (like autopay or tracking utilization) that your future self will thank you for?

📬 Subscribe

Want more Solo-Money reflections and self-care strategies for building a sustainable financial life? Subscribe below to get updates when new posts go live.

Related reads:

- Solo-Money Series: The Emotional Toll of Student Loan Interest Coming Back – selfcareportfolio

- Solo-Money Series: What My Spending Habits Revealed About My Self-Worth – selfcareportfolio

- Solo-Money Series: How I Found Free and Discounted Gym Memberships Through Insurance and Work – selfcareportfolio